On 30 May UK taxpayers can take comfort in the knowledge that this year they have unofficially stopped paying everything they earn to the taxman.

A day later than last year, Thursday 30 May marks ‘Tax Freedom Day1’, a notional date in the year when Brits can celebrate being tax-free. Calculated annually by the Adam Smith Institute, by adding up all the taxes people pay in the UK and dividing by their incomes, it will take the average UK worker 150 days this year to pay off their tax debt.

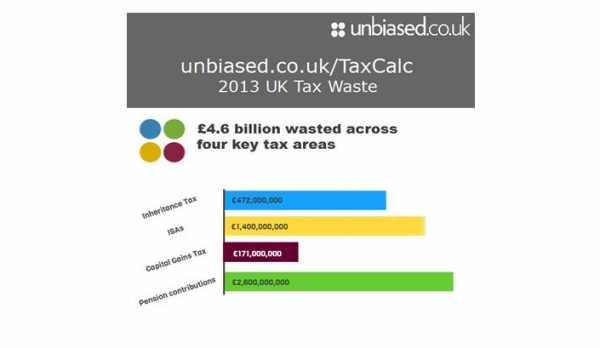

But UK taxpayers could spend more time earning for their own benefit if they looked carefully at their tax planning. Recent figures from the unbiased.co.uk/TaxCalc 2013 Tax Action research2 show that UK taxpayers are set to gift a whopping £4.6 billion in unnecessary tax this year.

Looking specifically at four key areas of tax, (Individual Savings Accounts (ISAs), tax relief on pension contributions, Capital Gains Tax (CGT) and Inheritance Tax (IHT)); the research shows that nearly 4.3 million people not currently paying into a pension but who would potentially consider it are wasting £2.6 billion3, just by not making use of the tax relief on pension contributions.

The latest HMRC figures show the average pension contribution made by individuals per year is £3,010. Based on this level of contribution, employees could boost their pension pot by as much as £602 each, and £2.6 billion collectively, simply by taking advantage of tax relief on pension contributions, and this is just for basic rate payers. Higher rate tax payers will benefit even more.

Of the four areas, the second biggest area of tax waste is ISAs with £1.4 billion set to be wasted overall, of which more than £1.3 billion is through not being efficient with cash ISA savings and £62 million by investors not holding their existing investments within a stocks and shares ISA.

This was followed by £472 million in inheritance tax andas much as £171 million in unnecessary CGT payments, simply by UK taxpayers not using tax efficient strategies and allowances available to them.

The overall tax waste mountain translates into £153 on average4 being wasted per individual taxpayer.

This year, unbiased.co.uk, the professional adviser search website for consumers, is calling on Brits to make the 30 May their ‘Tax Action Day’.

Karen Barrett, Chief Executive of unbiased.co.uk, comments: “This year Brits will spend 150 days paying off their tax debt; that’s one more day to the taxman compared with last year. It’s clear there’s plenty that taxpayers can be doing to take tax action and potentially bolster their pockets as a result. We all know that our taxes go to benefit the whole community, at a local and national level (and beyond), but nobody should be paying more tax than the rules require of them.

“It’s important that we help ourselves to be as efficient as we can with our finances and use the tax reliefs and allowances available to us. We are calling on taxpayers to take tax action now to move their personal Tax Action Day forward. Those unsure about their current tax position should enlist the help of a professional tax adviser, who can review their financial situation and ensure they are being as tax efficient as possible. To find a whole of market financial adviser that specialises in tax or an accountant visit www.unbiased.co.uk.”

ENDS

Notes to editors:

1. Tax Freedom Day is a floating date calculated every year (from 1 January) by the Adam Smith Institute: see www.adamsmith.org for details.

2. Tax Action Report 2013 has been carried out by Opinium Research on behalf of unbiased.co.uk and TaxCalc.

3. Based on desk research by Opinium Research: 4,284,100 adults in the UK are currently in employment and not contributing towards a pension but based on their age and earnings, are very likely to consider contributing towards a pension. Multiplying those 4.3 million adults by the annual income tax savings of £602, results in a total avoidable waste of £2,579,028,200 or £2.6 billion.

4. Based on the average number of taxpayers, according to HMRC:http://www.hmrc.gov.uk/statistics/taxpayers/table1-4.pdf. This calculation is based on the overall amount of tax wasted across different groups of taxpayers, and while not every single taxpayer is affected in the same way, the average amount of £153 has been provided to illustrate how much could be wasted across the UK population.

For more information contact:

Anna Schirmer/ Emily Falla/ Kate Aitchinson, Lansons Communications: 020 7294 3682

For expert commentary or case studies from over 200 media-friendly advisers, journalists should visit unbiased.co.uk Bluebook - The Media IFA Network

Twitter: @unbiased_co_uk

LinkedIn: Unbiased.co.uk - Online networking for professional advisers

About unbiased.co.uk, the professional advice website

Unbiased.co.uk is the UK's most comprehensive free professional adviser search website, focused on empowering users with the resources they need to make better informed financial and legal decisions. We not only help consumers and businesses find the best adviser for their needs from over 20,000 IFAs, financial advisers, mortgage advisers, solicitors and accountants listed on our search but we also help them research the market by providing relevant information and tools. At unbiased.co.uk we like to be transparent about what we do and aim to provide the easiest way for consumers to find and compare advisers meeting their requirements.

The unbiased.co.uk website launched in 1998 and rapidly became the UK’s leading online destination for consumers and businesses looking to find an adviser. Now attracting over one million visitors a year, unbiased.co.uk is the default adviser directory for consumer websites recommending their audience to ‘find an adviser’.

Unbiased Ltd promotes the benefits of financial and legal advice to consumers and businesses and would like to thank the following companies for their support:

|

Alliance Trust |

NS&I |

|

Aviva |

Opinium Research |

|

AXA Wealth |

Prudential |

|

Bright Grey |

Royal London 360° |

|

Canada Life Ltd |

Schroders |

|

Clerical Medical Investment |

Scottish Life |

|

Hearthstone Investments Plc |

Scottish Widows Plc |

|

Legal & General |

Standard Life Assurance Limited |

|

Lockton |

TaxCalc |

|

MetLife |

Zurich Intermediary Group |

Unbiased Ltd - Registered Office: 12-14 Berry St, London, EC1V 0AU. Registered in England: No. 06775878.

Category: Tax action Tagged: