UK adults are putting their financial security at risk according to new research from unbiased.co.uk, the professional advice website, which reveals three in ten (30%) of consumers are uninsured in vital areas such as life insurance, income protection, critical illness and mortgage payment protection.

Furthermore, a growing number of consumers are now cutting back on their insurance policies, with almost one in 10 (8%) cutting back on important areas in the past 12 months.

“Consumers looking to tighten their purse strings are now adding insurance policies to the ‘cancellation list’, choosing to let go of their financial security in favour of some extra cash in their pockets. The ‘it won’t happen to me’ attitude seems to be at the forefront of people’s minds as they fail to realise what this may cost them in the future.” said Karen Barrett, CEO of unbiased.co.uk.

She added: “We need to raise awareness amongst consumers that the state is no longer prepared to intervene in the event of ill-health or redundancy; it is up to each of us to take on this financial responsibility.”

Our recent survey found that over 15 million UK adults** would be financially at risk if they were to lose their main source of income , yet despite this, 15% of people don’t see income protection as necessary and 15% claim that they can’t afford it.

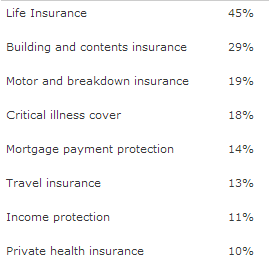

In addition, when consumers were asked which insurance products they rated as most important in providing them and their family with long-term financial security, income protection was ranked seventh, below mortgage payment protection, motor insurance and building and contents insurance.***

“Although it is important to protect financially against loss of or damage to valuable items and possessions, consumers should not lose sight of the importance of protecting their main source of income. Income protection is designed to protect you should you be unable to work and ensures that we would still be able to pay for the car, the mortgage and the everyday essentials if we lost our full salary.

“There is an array of protection products on the market at the moment and as recent news has illustrated some policies fail to pay out in certain circumstances. If you are unsure of the terms and conditions of your policy and whether you will be fully protected then seek help from an independent financial adviser (IFA). They will take into account your terms of employment and will check what occupation the policy covers to ensure you are fully protected.

“If you are worried that the cost of insurance is too much of a burden on your finances then speak to an IFA to decide where you are most at risk. An IFA will be able to recommend protection products to match your individual needs as well as seek out policies which are more likely to suit your pocket.

“Consumers looking to find an IFA who specialises in protection policies can carry out a free and confidential search at www.unbiased.co.uk.”

ENDS

* Research based on Opinium Research results, 2010 online interviews, from 21 February – 23 February 2012 (nationally representative)

** Opinium Research carried out an online poll of 2,015 UK adults from 2 September to 5 September 2011

*** Table ranks insurance products in order of most important according to what consumers feel would provide them and their family with long-term financial security

For more information contact:

Lisa Grando/ Emily Falla/ Maddy Morgan Williams, Lansons Communications: 020 7294 3682

For expert commentary or case studies from over 190 media-friendly IFAs, journalists should visit www.unbiased.co.uk/bluebook.

Twitter: @unbiased_co_uk

LinkedIn: Unbiased.co.uk - Online networking for professional advisers

About unbiased.co.uk, the professional advice website

The unbiased.co.ukportal is a free and confidential UK-wide search matching consumers with local professional advisers: ‘find an IFA’, ‘find a mortgage adviser’, ‘find a solicitor’, and ‘find an accountant’. These searches enable consumers to find professional advisers by postcode, area of specialism, qualification and payment method. In 2011, unbiased.co.uk fulfilled around 450,000 searches for local, professional advice.

Unbiased Ltd promotes the benefits of independent financial advice to consumers. Unbiased Ltd is supported by the following companies:

Unbiased Ltd - Registered Office: 12-14 Berry St, London, EC1V 0AU. Registered in England: No. 06775878

Category: Protection Tagged: