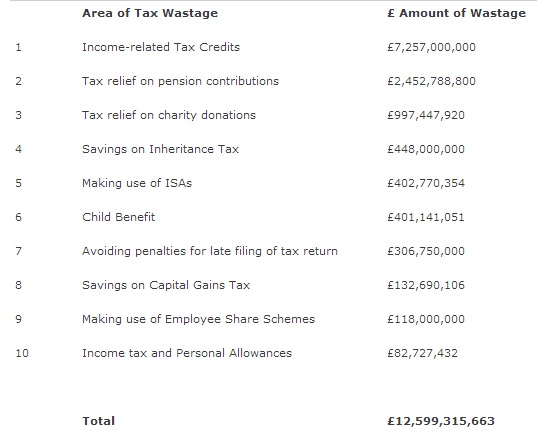

Unbiased.co.uk’s latest Tax Action Report1 reveals that unclaimed income-related tax credits are by far the largest area of unused tax allowances, resulting in £7.3 billion remaining unclaimed through people failing to make use of their child tax credits, working tax credits and pension credits.

The professional advice website’s annual Tax Action campaign endeavours to help consumers make the most of the tax advantages available to them, looking at benefits and allowances as well as tax breaks and unnecessary tax payments. As part of this campaign, unbiased.co.uk is urging taxpayers to check and renew their tax credit entitlements ahead of 31 July deadline to ensure that they have been paid and will continue to be paid the right money.

Child and working tax credits

Unbiased.co.uk’s latestTax Action report reveals that £2.16 billion is wasted through unclaimed child tax credit and a further £2.7 billion is wasted through working tax credit that remains unclaimed. This results in an astonishing £4.9 billion of unclaimed child and working tax credits.

Pension credits

Unbiased.co.uk’sresearch also showsthat failure to claim pension credits results in tax wastage of £2.4 billion.

Table 1: The top 10 areas of tax wastage in the UK

Karen Barrett, Chief Executive of unbiased.co.uk, comments: “This year, as in previous years, taxpayersare at risk of missing out on thousands of pounds by failing to renew their tax credits before the impending 31 July deadline, or by failing to fill out their forms correctly.

“Take care to fill out your forms correctly; any errors can often jeopardise the amount you will eventually receive. And if you miss this week’s deadline, although your tax credit payments will stop, all is not lost; you will be given a 30 day grace period to get your tax credits re-instated.

“It is also important to keep the Tax Office up to date with any changes to your personal and financial circumstances; otherwise, you could risk missing out on your full tax credit entitlement or being overpaid. Whilst getting more than you are entitled to may sound good, you are likely to face the nightmare of having to repay all the money they’ve given you at a later date.

“Whilst the tax credit system may seem complicated at times, don’t let it put you off otherwise you may miss out on money that is rightfully owed to you. The system has been set up to help those who need it most and it really is as simple as this - if you don’t claim your tax credit or benefit it expires.

“So take ‘Tax Action’ now to ensure that you have been paid and will continue to be paid the right money! Ensuring that you are receiving all the tax credits owed to you will leave you in a better place to plan financially for the future.”

ENDS

Tax Action infographic available on request

1 Tax Action Report 2012 has been carried out by Opinium Research on behalf of unbiased.co.uk

The estimations in this release were made prior to changes in the Chancellor’s Budget in March 2012

For more information contact:

Karen Barrett, Chief Executive, unbiased.co.uk: 020 7107 2060

Lisa Grando/ Emily Falla/ Maddy Morgan Williams, Lansons Communications: 020 7294 3682

For expert commentary or case studies from over 200 media-friendly IFAs, journalists should visit www.unbiased.co.uk/bluebook.

Twitter: @unbiased_co_uk

LinkedIn: Unbiased.co.uk - Online networking for professional advisers

About unbiased.co.uk, the professional advice website

The unbiased.co.ukportal is a free and confidential UK-wide search matching consumers with local professional advisers: ‘find an IFA’, ‘find a mortgage adviser’, ‘find a solicitor’, and ‘find an accountant’. These searches enable consumers to find professional advisers by postcode, area of specialism, qualification and payment method. In 2011, unbiased.co.ukfulfilled around 450,000 searches for local, professional advice.

Unbiased Ltd promotes the benefits of independent financial advice to consumers. Unbiased Ltd is supported by the following companies:

Unbiased Ltd - Registered Office: 12-14 Berry St, London, EC1V 0AU. Registered in England: No. 06775878)

Category: Tax action Tagged: